top of page

Support EITC

at Alliance

FUND SCHOLARSHIPS

for Christian Education

Better Education

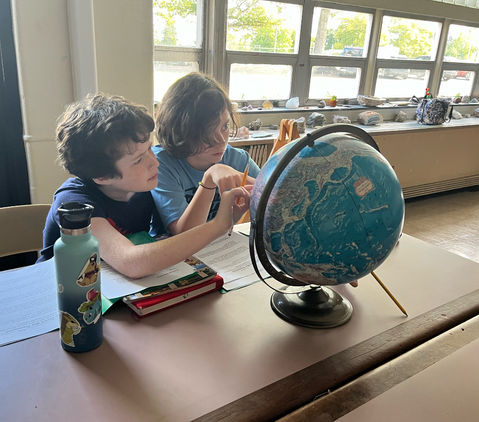

Stronger academic opportunities for students.

More Opportunities

New experiences in and out of the classroom.

Upgraded Facilities

Improved buildings and learning spaces.

Better Sports Resources

Improved equipment and fields for athletes.

Competitive Teacher Pay

Helps attract and keep top educators.

EITC IN 4 EASY STEPS

Any tax payer can contribute.

Receive back a 90% state income tax credit!

Step 1 Calculate

Step 2 Contribute

Step 3 Tax File

Step 4 Receive Refund

Learn More, Ask

Beth Bromwell

DIRECTOR OF DEVELOPMENT

bbromwell@alliancechristian.org

bottom of page